If at first you don’t succeed, try and try again.

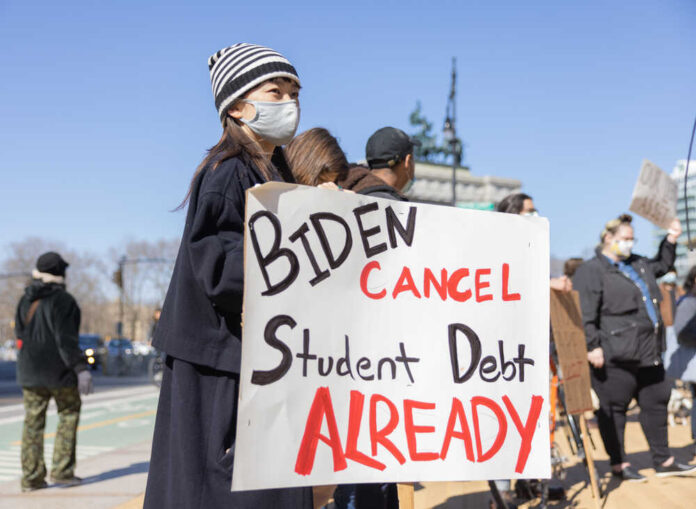

That’s apparently the mantra of President Joe Biden when it comes to canceling federal student loan debt, and it looks like it’s going to work.

The Biden administration suffered a big setback when the Supreme Court ruled that the president’s student loan forgiveness plan was unconstitutional. That plan would have allowed some borrowers to have as much as $20,000 of their federal student loan debt wiped away.

Now that that plan isn’t allowed, Biden is taking a different route to accomplish the same student loan debt relief.

He recently unveiled an updated repayment plan for federal student loan debt that could see certain borrowers reduce their monthly repayments to $0. The plan is called Saving on a Valuable Education, and Republicans have pushed back on it considerably already, saying the “objective remains unchanged” between the two proposals.

People have already warned that they intend to file lawsuits to stop the SAVE plan in its tracks before it can launch, just like happened with the first student debt forgiveness plan.

But, many political experts have said that even if the SAVE plan isn’t successfully implemented, the fact that Biden has put it forward and is continuing down this path is actually a win-win situation for his re-election campaign.

Jay Townsend, a political consultant, told Newsweek recently that no matter whether the SAVE plan stands up to the likely legal challenges, Biden is still probably going to see a boost from voters.

Townsend said that if the Supreme Court ends up blocking this plan, too, Biden still will benefit from “great anger fuel for a political campaign next year.”

Student loan borrowers certainly won’t be able to fault Biden and the Democrats if the forgiveness plans don’t go through. To the contrary, if these borrowers don’t see any relief, they’re likely to actually blame Republicans, since the conservative majority on the Supreme Court is the group that will have banned it from going into practice.

Northeastern University law professor Daniel Urman recently said that the relief plans Biden is putting forth “symbolize his efforts to relieve millennials and Gen Z voters of their staggering college debt.” He added that these efforts alone could easily boost voter turnout among these younger constituents in the 2024 election – most of which would likely vote for Biden.

Almost 35% of all Americans between the ages of 18 and 29 have reported that they have at least some student loan debt. More than 32% of all student loan debt in America is held by people who are in their 30s, the Education Data Initiative reported.

Only 4% of federal student loan debt is held by people who are at least 62 years old.

Student loan debt as an issue can be a polarizing one across the political and age spectrum, but it’s a particularly important one to younger voters. As Claremont McKenna College political scientist John Pitney said:

“Many average voters are skeptical about student debt relief, but it’s not their top issue. For young borrowers, it is a life-shaping concern that could drive them to the polls.”