The Federal Reserve just published a study on how a digital dollar might be deployed in the United States, following in the footsteps of the eleven other nations that have already established central bank digital currencies.

Concerns have been raised, however, concerning the complete removal of currency as a form of payment and the extent to which the government could monitor an individual’s financial situation.

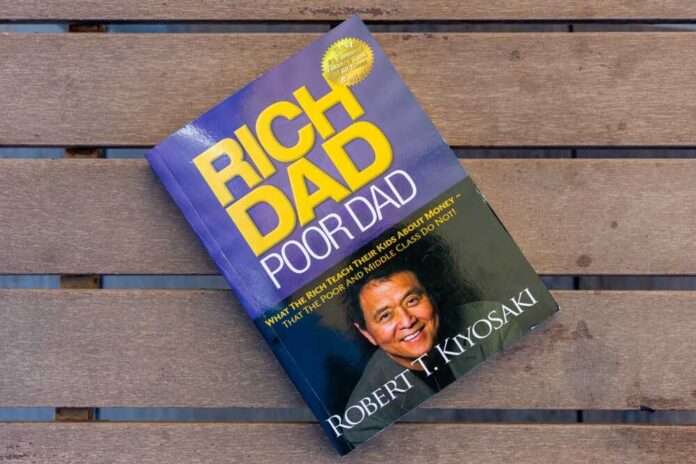

Robert Kiyosaki, the author of Rich Dad Poor Dad, has warned that introducing “dystopian” CBDCs will allow the federal government to monitor all purchases.

In a recent episode of his podcast, “The Rich Dad,” Robert Kiyosaki warned about the potential for CBDCs to usher in unprecedented government surveillance of American citizens.

“The most significant worry we have about FedCoin, also known as CBDC, is that it will compromise our privacy. According to Kiyosaki, by monitoring every transaction, they will have every detail of our consumption and spending. This will also occur when we receive people distributing their resources.”

Kiyosaki noted that in all essential respects, it is a carbon copy of George Orwell’s dystopian society that was portrayed in 1984. Big Brother will be continually watching our financial activities, and this is precisely the problem with central bank digital currency, also known as the Fed Coin.

The author cautioned readers, “It violates my privacy, and they have no business knowing how I allocate my resources.”

In light of these concerns, Representative Tom Emmer (R-Minnesota) has proposed legislation preventing the Federal Reserve from establishing CBDCs and requiring the Fed to maintain transparency with Congress regarding its investigation into the matter.

CBDCs are being advocated on the assumption that they will boost a person’s financial freedom; nevertheless, detractors have stated that the system would allow the state to put spending limits and decide what items individuals can purchase.

The amount of money an individual can put away for their future could likewise be limited by setting negative interest rates on their savings accounts.